AML CHECKS

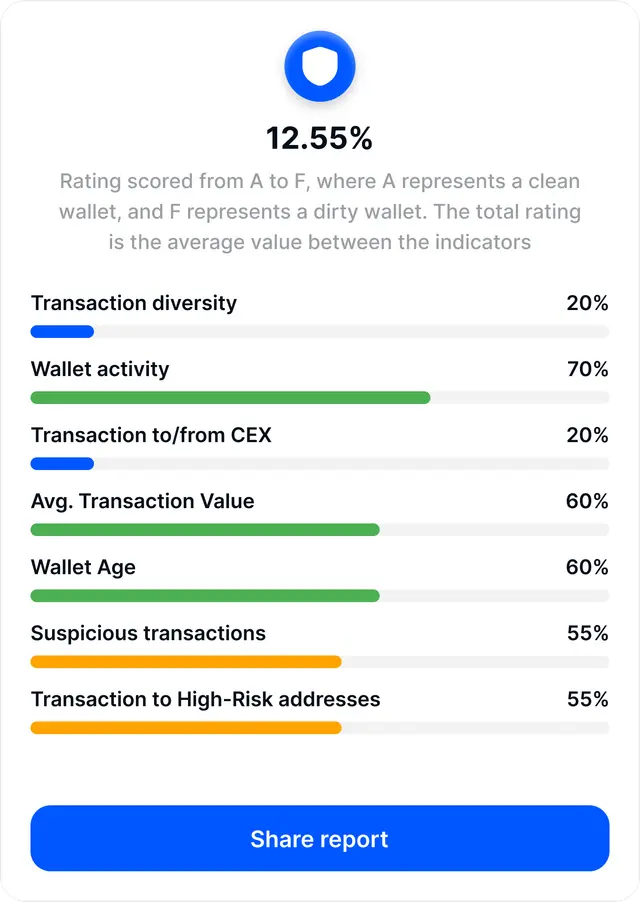

We screen your wallets and transactions for illicit funds

Protection

Protection against issues with exchanges or banks.

Get free report

1st report free for new clients

Verified Company

Trusted by Trustpilot. Date of foundation 2019. 20,000 users per month.

You Should Know

Anti-money laundering (AML) checks are procedures established by businesses to stop and spot illegal activities involving the movement of money from criminal activities.

These checks are essential in keeping financial integrity and complying with legal requirements.

Try free now!

Why are AML checks important?

By preventing the laundering of dirty money, businesses can help disrupt criminal networks and reduce the risk of financing terrorism. Additionally, sticking to anti-money laundering regulations can improve an organisation's reputation and build trust with customers and stakeholders.

-

Protection against issues with exchanges or banks

-

Counterparty Verification

-

Detailed report

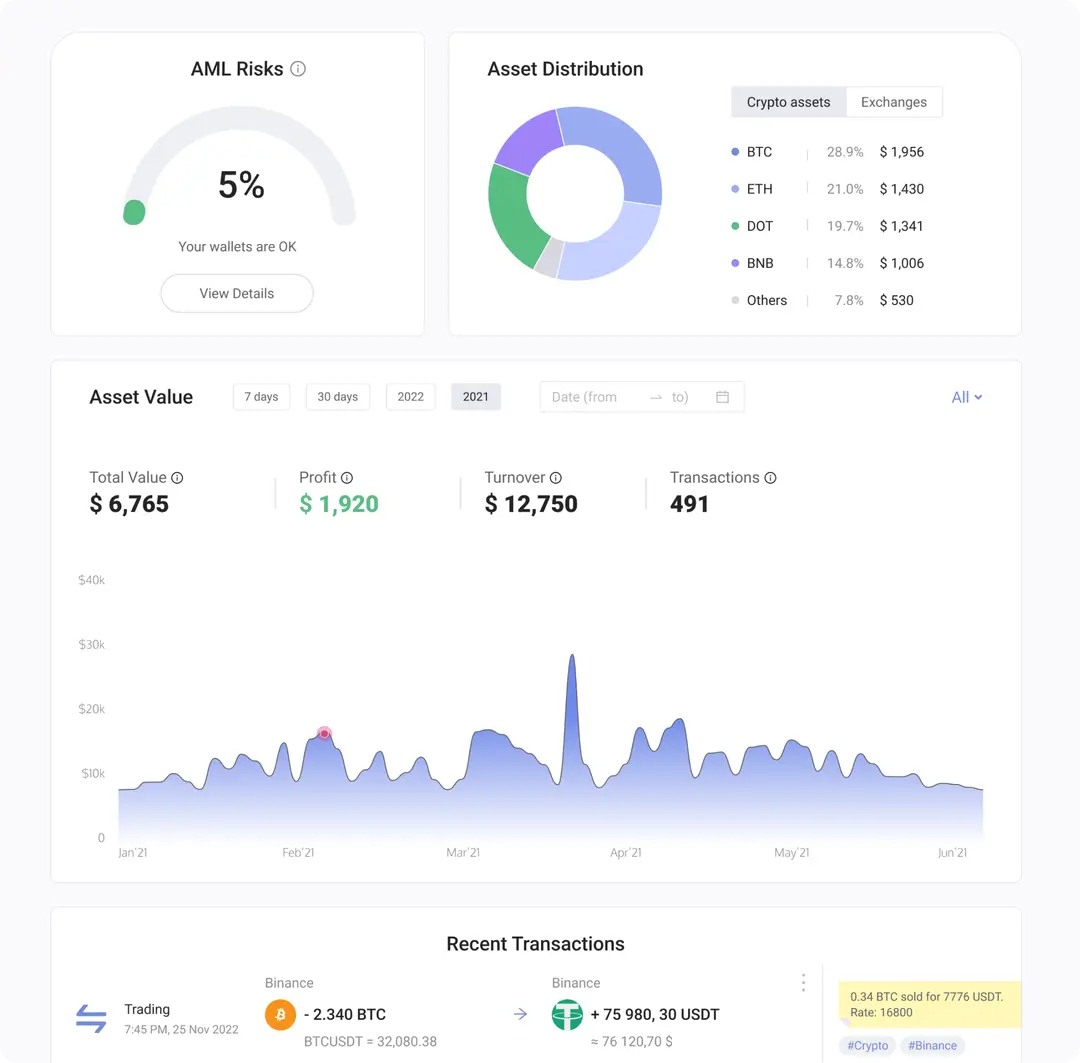

Portfolio Tracker

Functional dashboard

-

Data from all accounts in one place

-

Track your P&L and asset allocation

-

Screen AML risks across wallets

Transaction classification

-

Specify the nature of your operations

-

Attach supporting documents

-

Generate tax reports and other docs

Control of all operations

-

Convenient navigation and transaction filtering

-

Notes & tags for better organization

-

Option to add operations manually

Pricing for personal use

Starter

Best option for personal use & for your one wallet.

- Individual configuration

- No setup, or hidden fees

- Wallets max count: 3 wallets

- Premium support: 6 months

Company

Relevant for multiple uses, extended & premium support.

- Individual configuration

- No setup, or hidden fees

- Wallets max count: 10 wallets

- Premium support: 24 months

Enterprise

Best for large scale uses and multiple wallets.

- Individual configuration

- No setup, or hidden fees

- Wallets max count: 20 wallets

- Premium support: 36 months